Pay TV revenue bottomed out in mid-2009 and is on a course of firm rebound ahead of FIFA World Cup 2010 and the new Barclays Premier League season.

The Group's cash position remains strong.

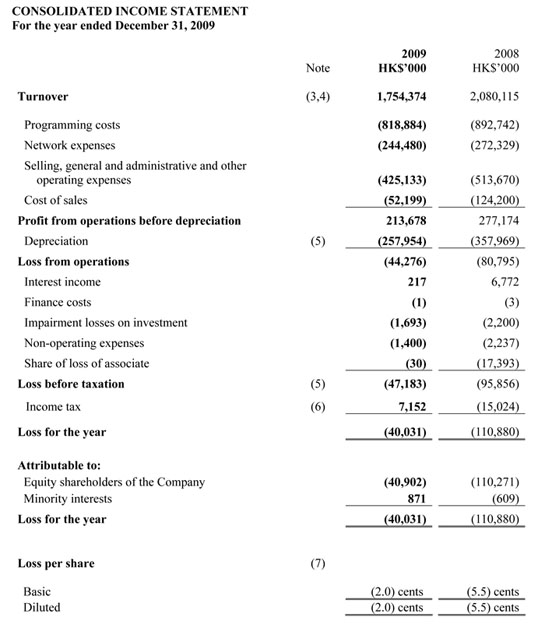

GROUP RESULTS

Turnover for the year ended December 31, 2009 decreased by 16% to HK$1,754 million (2008: HK$2,080 million). Group loss attributable to Shareholders amounted to HK$41 million (2008: HK$110 million). Basic and diluted loss per share were both HK$0.02 (2008: HK$0.055).

DIVIDENDS

The Board has resolved not to declare any final dividend for the year ended December 31, 2009.

MANAGEMENT DISCUSSION AND ANALYSIS

A. Review of 2009 Results

Consolidated turnover was 16% lower year-on-year at HK$1,754 million.

With successful cost control, operating costs including depreciation decreased by 17% to HK$1,799 million. Cost of sales decreased by 58% to HK$52 million, selling, customer service, general and administrative expenses decreased by 17% to HK$425 million, network costs decreased by 10% to HK$244 million and programming costs decreased by 8% to HK$819 million.

Loss after tax improved by 64% to HK$40 million as compared with HK$111 million loss in 2008. Basic and diluted loss per share were HK$0.02 as compared to loss per share of HK$0.055 in 2008.

B. Segmental Information

Pay TV

Subscribers were 9% higher year-on-year to exceed 1,000,000. Turnover decreased by 9% to HK$1,228 million. Operating costs after depreciation decreased by 6% to HK$1,273 million. Operating loss was HK$45 million (2008 Operating profit: HK$6 million).

Internet & Multimedia

Broadband subscribers were 6% lower year-on-year at 249,000 and the Voice conveyance service was 1% higher at 152,000 lines. Turnover decreased by 9% to HK$522 million. Operating costs after depreciation decreased by 16% to HK$359 million. Operating profit increased by 10% to HK$163 million.

C. Liquidity and Financial Resources

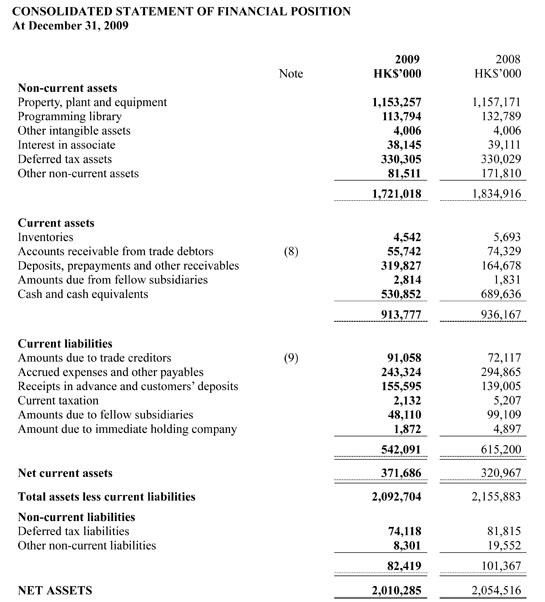

As of December 31, 2009, the Group had net cash of HK$531 million, as compared to HK$690 million a year ago.

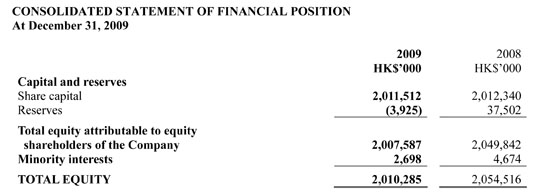

The consolidated net asset value of the Group as at December 31, 2009 was HK$2,010 million, or HK$1 per share.

The Group's assets, liabilities, revenues and expenses were mainly denominated in Hong Kong dollars or U.S. dollars and the exchange rate between these two currencies has remained pegged.

Capital expenditure during the year amounted to HK$261 million as compared to HK$144 million in 2008. Major items included set-top-boxes, network upgrade and expansion, TV production facilities as well as Internet & multimedia equipment.

The Group is comfortable with its present financial and liquidity position. Capital expenditure and new business development will be funded by cash generated from operations and, if needed, bank borrowings or other external sources of funds. The Group had short-term bank credit facilities of approximately HK$13 million which remained unutilised as of December 31, 2009.

D. Contingent Liabilities

At December 31, 2009, there were contingent liabilities in respect of guarantees, indemnities and letters of awareness given by the Company on behalf of subsidiaries relating to overdraft and guarantee facilities provided by banks up to HK$19 million, of which HK$6 million had been utilised by the subsidiaries.

E. Human Resources

The Group had 2,822 employees at the end of 2009 (2008: 2,954). Total gross amount of salaries and related costs incurred in the corresponding period amounted to HK$704 million (2008: HK$739 million).

F. Operating Environment and Competition

Despite the improvement in economic sentiment, the operating environment for the Group's core businesses remained challenging as the competition began to resort to pricing to protect market share, particularly towards the end of the year.

Instead of responding on price, the Group invested to strengthen its programming offer in the Pay TV sector and in a technology upgrade in the Broadband sector. The former has already started to pay back in the form of subscriber and revenue growth. The latter is at an early stage of deployment but is expected to significantly strengthen our competitiveness in 2010.

The year was marked by public outcry to open up the free TV market when the Government undertook a mid-term review of the broadcasting licences for the two free TV operators. In a bid to further exploit the Group's content and distribution advantage and after exhaustive study, we considered it an opportune time to apply for a free TV licence. The application was submitted in January and is being processed by the regulators.

G. Outlook

2009 has been a bitter sweet year with corporations still taking on the blunt of the financial tsunami in the first half and ending the year seeing signs of a general economic recovery.

The Group is no exception. We have taken stringent measures to control cost and streamline operations to meet bad times but more importantly, we have used the opportunity to reinvest.

The reinvestments have enabled us to parade a much stronger programme platform; a more robust defence system to protect our content integrity; and new technology to upgrade our broadband service and to launch new HDTV service.

We have begun to reap initial benefits from the investments and we are optimistic that we can sustain the growth momentum as overall economic conditions continue to rebound.

CODE ON CORPORATE GOVERNANCE PRACTICES

During the financial year ended December 31, 2009, all the code provisions set out in the Code on Corporate Governance Practices contained in Appendix 14 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited were met by the Company, except in respect of one code provision providing for the roles of chairman and chief executive officer to be performed by different individuals. The deviation is deemed necessary as, given the nature and size of the Company's business, it is at this stage considered to be more efficient to have one single person to hold both positions. The Board of Directors believes that the balance of power and authority is adequately ensured by the operations of the Board which comprises experienced and high calibre individuals, a substantial proportion thereof being independent Non-executive Directors.

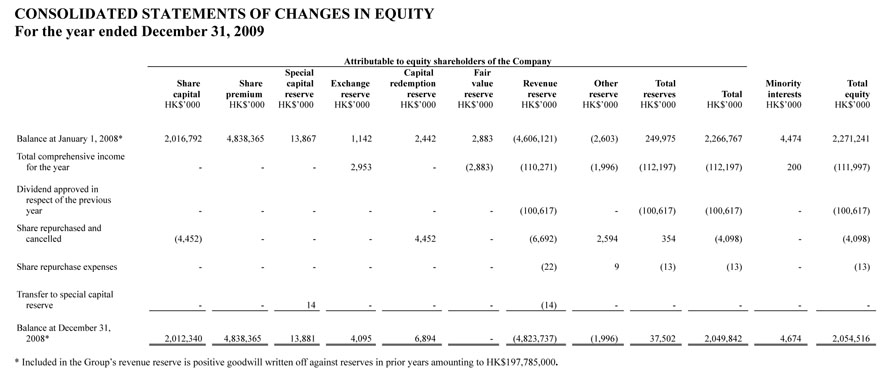

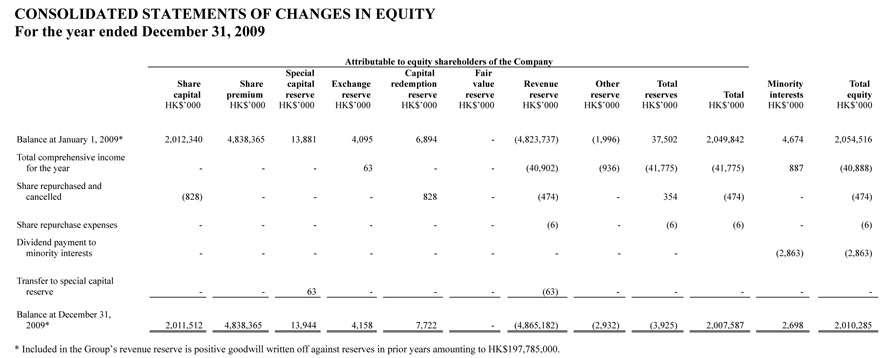

* Included in the Group's revenue reserve is positive goodwill written off against reserves in prior years amounting to HK$197,785,000.

NOTES TO THE FINANCIAL STATEMENTS

(1) Basis of preparation

The financial statements for the year ended December 31, 2009 have been prepared in accordance with all applicable Hong Kong Financial Reporting Standards ("HKFRS") which collective term includes all applicable individual Hong Kong Financial Reporting Standards, Hong Kong Accounting Standards ("HKAS") and Interpretations issued by the Hong Kong Institute of Certified Public Accountants ("HKICPA"), accounting principles generally accepted in Hong Kong and the requirements of the Hong Kong Companies Ordinance. They comply with the applicable disclosure provisions of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

(2) Impact of new and revised Hong Kong Financial Reporting Standards

The HKICPA has issued one new HKFRS, a number of amendments to HKFRSs and new Interpretations that are first effective for the current accounting period of the Group.

Of these, the following developments are relevant to the Group's financial statements:

- HKFRS 8, Operating segments

- HKAS 1 (revised 2007), Presentation of financial statements

- Improvements to HKFRSs (2008)

- Amendments to HKAS 27, Consolidated and separate financial statements

- cost of an investment in a subsidiary, jointly controlled entity or associate

- Amendments to HKFRS 7, Financial instruments: Disclosures

- improving disclosures about financial instruments

- HKAS 23 (revised 2007), Borrowing costs - Amendments to HKFRS 2, Share-based payment - vesting conditions and cancellations

The amendments to HKAS 27 and HKFRS 2, the revision to HKAS 23, and the improvements to HKFRSs (2008) have had no material impact on the Group's financial statements. The impact of the remainder of these developments on these financial statements is as follows:

HKFRS 8 requires segment disclosure to be based on the way that the Group's chief operating decision maker regards and manages the Group, with the amounts reported for each reportable segment being the measures reported to the Group's chief operating decision maker for the purposes of assessing segment performance and making decisions about operating matters. The adoption of HKFRS 8 has resulted in the presentation of segment information in a manner that is more consistent with internal reporting provided to the Group's top management. The adoption of HKFRS 8 has had no material impact on the reportable segments being identified and presented.

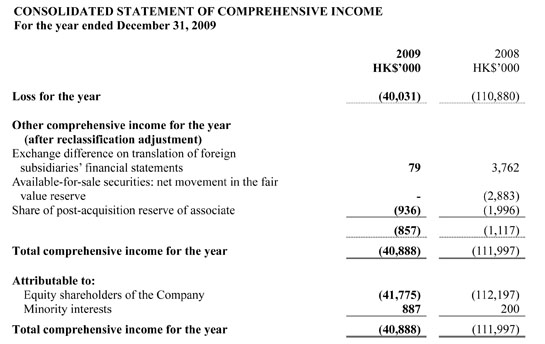

As a result of the adoption of HKAS 1 (revised 2007), details of changes in equity during the period arising from transactions with equity shareholders in their capacity as such have been presented separately from all other income and expenses in a revised consolidated statement of changes in equity. All other items of income and expense are presented in the consolidated income statement, if they are recognised as part of profit or loss for the period, or otherwise in a new primary statement, the consolidated statement of comprehensive income. The new format for the consolidated statement of comprehensive income and the consolidated statement of changes in equity has been adopted in this financial statements and corresponding amounts have been restated to conform to the new presentation. This change in presentation has no effect on reported profit or loss, total income and expense or net assets for any period presented.

As a result of the adoption of the amendments to HKFRS 7, the financial statements include expanded disclosures about the fair value measurement of the Group's financial instruments, categorising these fair value measurements into a three-level fair value hierarchy according to the extent to which they are based on observable market data. The Group has taken advantage of the transitional provisions set out in the amendments to HKFRS 7, under which comparative information for the newly required disclosures about the fair value measurements of financial instruments has not been provided.

(3) Turnover

Turnover comprises principally subscription and related fees for Pay TV and Internet services and Internet Protocol Point wholesale services. It includes advertising income net of agency deductions, channel service and distribution fees, programme licensing income, film exhibition and distribution income, network maintenance income and other related income.

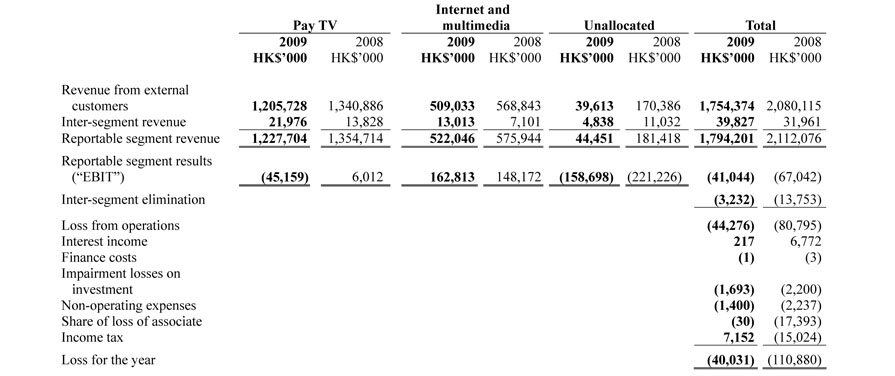

(4) Segment information

The Group managed its businesses according to the nature of services provided. Management has determined two reportable operating segments for measuring performance and allocating resources. The segments are Pay TV and Internet and multimedia.

The Pay TV segment includes operations related to the Pay TV subscription business, advertising, channel carriage, TV relay service, programme licensing, network maintenance, and miscellaneous Pay TV related businesses.

The Internet and multimedia segment includes operations related to Broadband and dial-up Internet access services, portal subscription, mobile content licensing, Voice Over Internet Protocol interconnection as well as other Internet access related businesses.

Management evaluates performance primarily based on earnings before interest and taxation ("EBIT"). Inter-segment pricing is generally determined at arm's length basis.

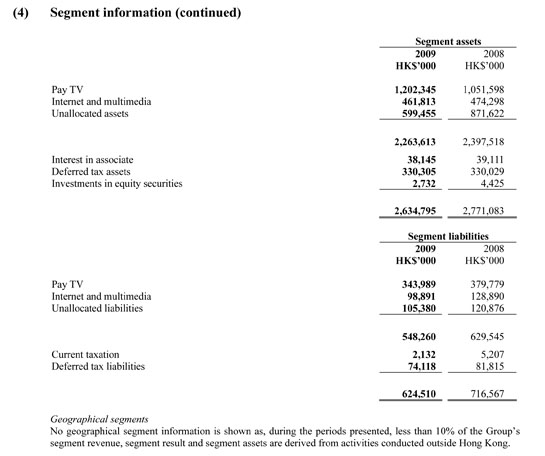

Segment assets principally comprise all tangible assets, intangible assets and current assets with the exception of interest in associate, investments in equity securities and deferred tax assets.Segment liabilities include all liabilities and borrowings directly attributable to and managed by each segment with the exception of current taxation and deferred tax liabilities.

In addition to receiving segment information concerning EBIT, management is provided with segment information concerning revenue (including inter-segment revenue).

Information regarding the Group's reportable segments as provided to the Group's senior management for the purposes of resource allocation and assessment of segment performance for the years ended 31 December 2009 and 2008 is set out below:

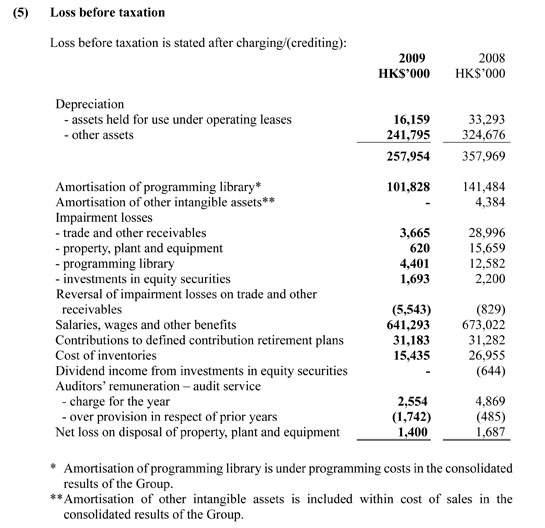

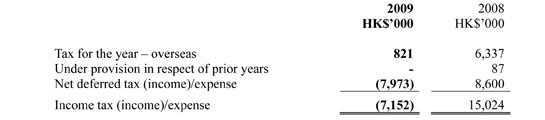

(6) Income tax

The provision for Hong Kong Profits Tax is calculated at 16.5% of the estimated assessable profits for the year (2008: 16.5%). Taxation for the overseas subsidiaries is charged at the appropriate rate of taxation ruling in the relevant countries. The income tax charge for the year ended December 31 represents:

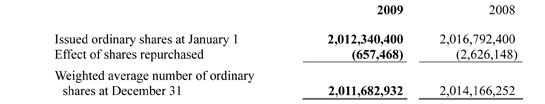

(7) Loss per share

The calculation of basic loss per share is based on the loss attributable to equity shareholders of the Company of HK$41 million (2008: HK$110 million) and the weighted average number of ordinary shares outstanding during the year of 2,011,682,932 (2008: 2,014,166,252). Weighted average number of ordinary shares

The calculation of diluted loss per share is based on the loss attributable to equity shareholders of the Company of HK$41 million (2008: HK$110 million) and the weighted average number of ordinary shares of 2,011,682,932 (2008: 2,014,166,252) after adjusting for the effects of all dilutive potential ordinary shares. All of the Company's share options did not have intrinsic value throughout 2008 and 2009. Accordingly, this has no dilutive effect on the calculation of dilutive loss per share in both years.

(8) Accounts receivable from trade debtors

An ageing analysis of accounts receivable from trade debtors (net of allowance for doubtful debts) is set out as follows:

(9) Amounts due to trade creditors

An ageing analysis of amounts due to trade creditors is set out as follows:

(10) Comparative figures

As a result of the application of HKAS 1 (revised 2007), Presentation of financial statements, and HKFRS 8, Operating segments, certain comparative figures have been adjusted to conform to current year's presentation and to provide comparative amounts in respect of items disclosed for the first time in 2009. Further details of these developments are disclosed in Note 2.

In addition, cost of sales was added on the face of the consolidated income statement which management of the Group considers that it would be better reflect the substance of the underlying transactions. Comparative figures of "network expenses" and "selling, general and administrative and other operating expenses" have been reclassified to conform to the current year's presentation.

(11) Review of Financial statements

The financial results for the year ended December 31, 2009 have been reviewed with no disagreement by the Audit Committee of the Group. This preliminary results announcement has been agreed by the Group's Auditor.

PURCHASE, SALE OR REDEMPTION OF SHARES

During the year, the Company repurchased on the Stock Exchange a total of 828,000 ordinary shares at an aggregate price of HK$474,400.

Save as disclosed above, neither the Company nor any of its subsidiaries has purchased, sold or redeemed any listed securities of the Company during the financial year ended December 31, 2009.

BOOK CLOSURE

The Register of Members of the Company will be closed from Monday, May 31, 2010 to Wednesday, June 2, 2010, both days inclusive, during which period no share transfers can be registered. In order to ascertain shareholders' rights for the purpose of attending and voting at the forthcoming Annual General Meeting, all transfers, accompanied by the relevant share certificates, must be lodged with the Company's Registrars, Tricor Tengis Limited, at 26th Floor, Tesbury Centre, 28 Queen's Road East, Wanchai, Hong Kong, not later than 4.30 p.m. on Friday, May 28, 2010.

By Order of the Board

Wilson W. S. Chan

Company Secretary

Hong Kong, March 12, 2010

As at the date of this announcement, the Board of Directors of the Company comprises Mr. Stephen T. H. Ng, Mr. William J. H. Kwan and Mr. Paul Y. C. Tsui, together with three independent non-executive Directors, namely, Mr. T. K. Ho, Mr. Patrick Y. W. Wu and Mr. Anthony K. K. Yeung.