|

August 10, 2007 |

i-CABLE

COMMUNICATIONS LIMITED

Stock Code: 1097

Interim Results Announcement for the six months ended June 30, 2007

Results Highlights

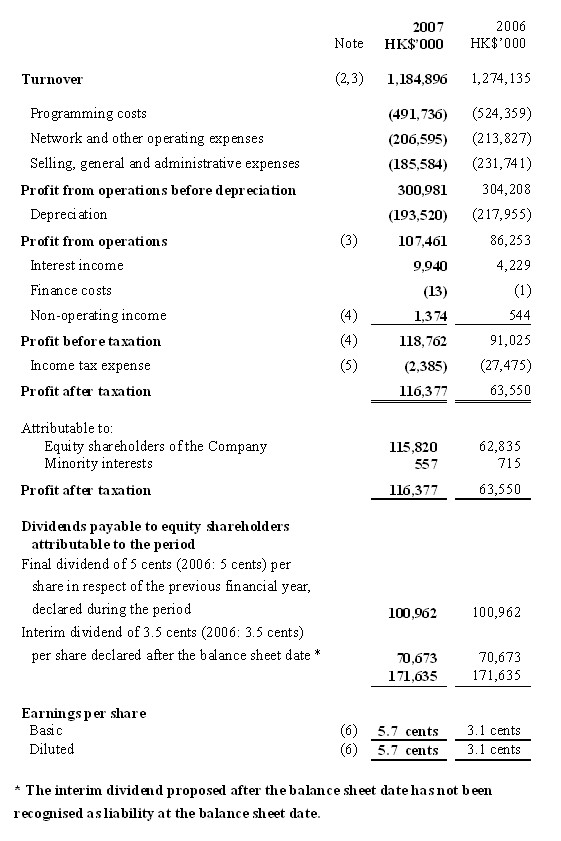

- Turnover decreased by 7% to HK$1,185 million (2006: HK$1,274 million).

- Net profit before tax increased by 30% to HK$119 million (2006: HK$91

million).

- Net profit after tax increased by 83% to HK$116 million (2006: HK$64

million).

- Capital expenditure decreased by 41% to HK$71 million (2006: HK$121

million).

- Interim dividend per share unchanged at HK$0.035 (2006: HK$0.035).

Pay TV

- Subscribers increased by 6% to 830,000 during the six-month period.

- Turnover decreased by 14% to HK$827 million (2006: HK$966 million).

- Operating profit increased by 2% to HK$100 million (2006: HK$98 million).

Internet & Multimedia

- Broadband subscribers base was stable at 324,000.

- Turnover was maintained at HK$295 million (2006: HK$296 million).

- Operating profit increased by 27% to HK$86 million (2006: HK$68 million).

GROUP RESULTS

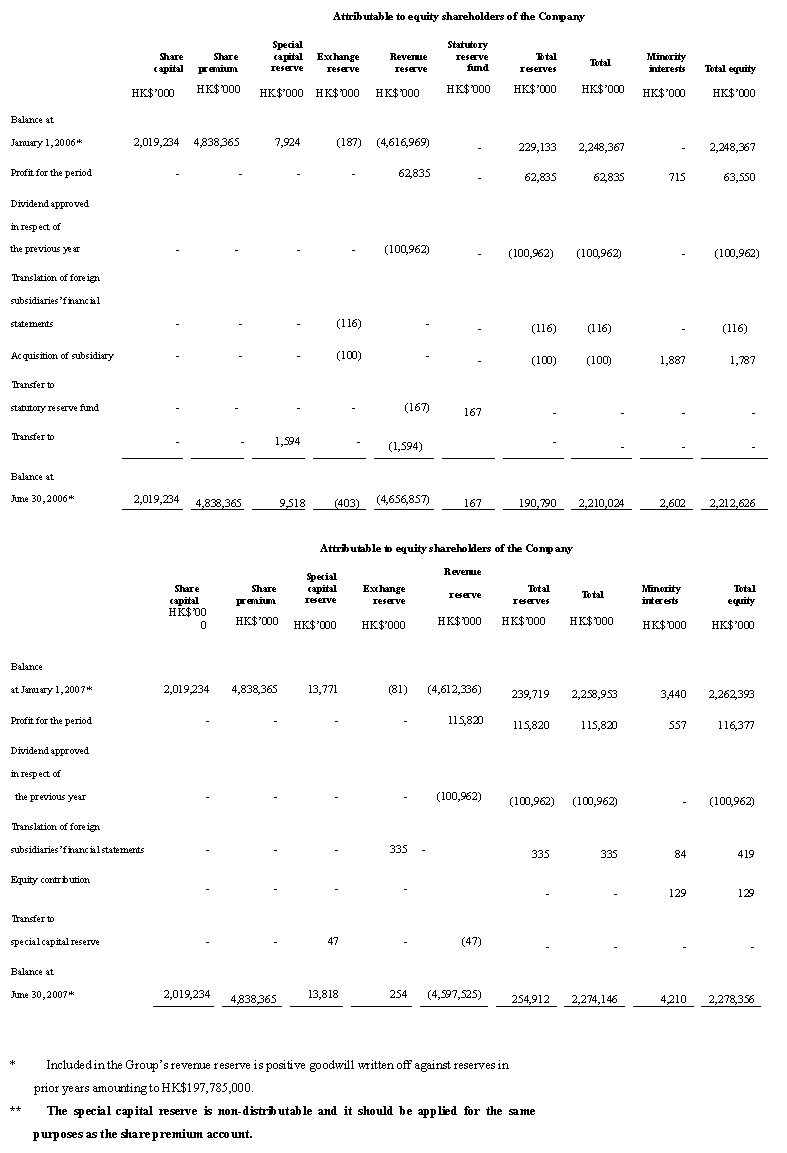

The unaudited Group profit attributable to Shareholders for the six months ended June 30, 2007 amounted to HK$116 million, as compared to HK$63 million for the corresponding period in 2006. Basic and diluted earnings per share were both HK$0.057 for 2007, as compared to both HK$0.031 last year.

INTERIM DIVIDEND

The Board has declared an interim dividend in respect of the six-month period ended June 30, 2007 of HK$0.035 (2006: HK$0.035) per share, payable on Tuesday, October 9, 2007 to Shareholders on record as at September 28, 2007.

MANAGEMENT DISCUSSION AND ANALYSIS

A. Review of 2007 Interim Results

The Group reported a satisfactory performance during the first six months ended June 30, 2007 despite intensifying competition. With the enhancement of the programming platform particularly in local production, as well as successful acquisition and retention strategies, the Pay TV subscriber base grew to 830,000. Profit after tax increased by 83% to HK$116 million.

Consolidated turnover decreased by 7% to HK$1,185 million, partly due to non-recurring turnover in 2006. Notably, revenue from new businesses such as film production and the advertising venture in the Mainland increased by 260% from a small base.

With effective cost management and resource redeployment, operating costs before depreciation decreased by 9% to HK$884 million. Programming costs decreased by 6%; network and other operating costs by 3%; and selling, general and administrative expenses by 20%.

Earnings before interest, tax, depreciation and amortisation ("EBITDA") was virtually unchanged at HK$301 million.

Depreciation decreased by 11% to HK$194 million to follow the steady trend in recent years.

Profit from operations therefore increased by 25% to HK$107 million, while profit before tax increased by 30% to HK$119 million and profit after tax increased by 83% to HK$116 million.

Basic earnings per share were 5.7 cents as compared to 3.1 cents in 2006.

B. Segmental Information

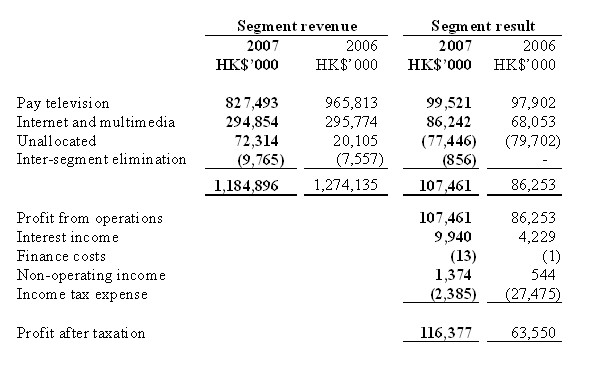

Pay Television

Subscribers increased by 43,000 or 6% in the period to 830,000 as compared to 32,000 or 4% during the same period last year. However, turnover decreased by 14% to HK$827 million, mainly attributable to dilution from lower yield subscriptions and a return to normality for commercial airtime sales after FIFA World Cup in 2006. Operating costs after depreciation decreased by 16% to HK$728 million primarily due to the aforementioned decrease in programming costs, marketing and sales spending and depreciation charge. Operating profit increased by 2% to HK$100 million (2006: HK$98 million).

Internet & Multimedia

The Broadband subscriber base was largely stable at 324,000 in a mature marketplace; yield was also stable. The VoIP conveyance service reported 179,000 lines in service as of the period end, as compared to 168,000 at 2006 year end. Turnover was sustained at HK$295 million. Operating costs after depreciation decreased by 8% to HK$209 million partly due to lower depreciation charges. Operating profit increased by 27% to a record high of HK$86 million.

C. Liquidity and Financial Resources

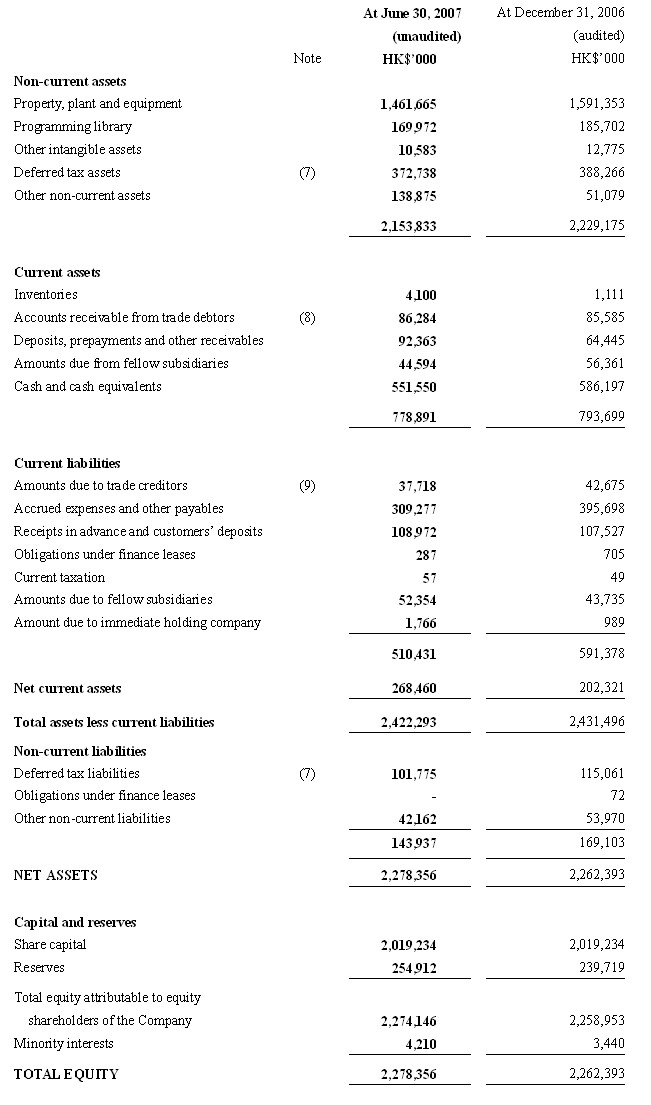

As of June 30, 2007, the Group had net cash of HK$552 million, as compared to HK$325 million a year ago.

The consolidated net asset value of the Group as at June 30, 2007 was HK$2,278 million, or HK$1.1 per share. As at June 30, 2007, the Group had property, plant and equipment with a net book value of approximately HK$721,000 held under finance lease contract.

The Group's assets, liabilities, revenues and expenses were mainly denominated in Hong Kong dollars or U.S. dollars and the exchange rate between these two currencies has remained pegged.

Capital expenditure during the period amounted to HK$71 million, 41% lower than the same period last year. Major items included further network upgrade and expansion, cable modems, investment in information systems, television production facilities as well as other Internet & Multimedia equipment.

The Group's further ongoing capital expenditure and new business development will be funded by cash to be generated from operations and, if needed, bank borrowings or other external sources of funds. The Group also had total short-term bank credit facilities of approximately HK$231 million which remained unutilised as of June 30, 2007.

D. Contingent Liabilities

At June 30, 2007, there were contingent liabilities in respect of guarantees, indemnities and letters of awareness given by the Company on behalf of subsidiaries relating to overdraft and guarantee facilities of banks up to HK$237 million, of which only HK$6 million have been utilised by the subsidiaries.

E. Human Resources

The Group had a total of 2,855 employees at the end of June 2007 (2006: 3,338). Total gross amount of salaries and related costs incurred in the corresponding period amounted to HK$359 million (2006: HK$425 million).

The Group is dedicated to attracting, retaining and developing employees of high quality and to motivating them to excel in their careers by promoting a pay for performance culture, linking remuneration and reward to Group performance as well as offering them with career advancement opportunities.

Being a caring employer, the Group continues to promote corporate citizenship and participate in community and social welfare activities both through making donations to non-profit organisations and social welfare agencies and encouraging employees to participate in volunteer services.

F. Operating Environment and Competition

The Pay TV terrain was a challenge with the competition attacking the market aggressively.

Responding to the changing market conditions, the Group adjusted its marketing and retention offers since the end of last year. Coupled with enhancement of our local programming platform, we have held up our position in the market with some degree of success.

On the sports front, the highlight during and subsequent to the period was the acquisition of the crown jewels of sports, the 2010 FIFA World Cup in South Africa, the Winter Olympics in Vancouver and the 2012 Summer Olympics in London, all on an exclusive basis for Hong Kong. The acquisitions affirmed CABLE TV's long-term commitment towards maintaining solid top-rated sporting programme offerings and was greeted enthusiastically by local sports fans.

The Broadband market is mature and ex-growth. Competition will therefore shift to service quality, after-sales service quality as well as value-added services.

G. Outlook

The outlook for the remainder of the year is optimistically cautious, particularly for the Pay TV segment, as competition is expected to remain keen.

The Group's various marketing and programming enhancement initiatives have enabled us to hold our market position. Additional initiatives will be launched in the second half of the year to enhance our competitiveness. We have also sharpened our sales force and taken steps to enhance our customer service with the recent consolidation into a new call centre to deliver quality after sales service.

A new challenge will arise towards the end of the year with the arrival of digital terrestrial television. Commercial television broadcasters have been assigned additional radio spectrum for digital services and will begin to roll out high definition television service and multi-channel platform. The Group will monitor these developments closely and implement plans to counteract as appropriate.

While there is no denying that the immediate future is a challenge, the Group is well prepared to face up to it.

CODE ON CORPORATE GOVERNANCE PRACTICES

During the financial period under review, all the code provisions set out in the Code on Corporate Governance Practices contained in Appendix 14 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited were met by the Company, except in respect of one code provision providing for the roles of chairman and chief executive officer to be performed by different individuals. The deviation is deemed necessary as, given the nature and size of the Company's business, it is at this stage considered to be more efficient to have one single person to hold both positions. The Board of Directors believes that the balance of power and authority is adequately ensured by the operations of the Board which comprises experienced and high calibre individuals with a substantial number thereof being independent Non-executive Directors.

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the six months ended June 30, 2007

* The interim dividend proposed after the balance sheet date has not been recognised as liability at the balance sheet date

CONSOLIDATED BALANCE SHEET

At June 30, 2007

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended June 30, 2007

NOTES TO THE INTERIM FINANCIAL REPORT

(1) Basis of preparation and comparative figures

The unaudited interim financial report has been prepared in accordance with the requirements of the Main Board Listing Rules of The Stock Exchange of Hong Kong Limited, including compliance with Hong Kong Accounting Standard 34 "Interim financial reporting" issued by the Hong Kong Institute of Certified Public Accountants ("HKICPA").

The HKICPA has issued certain new and revised Hong Kong Financial Reporting Standards ("HKFRSs") that are first effective or available for early adoption for the current accounting periods of the Group. We believe the adoption of these new and revised HKFRSs will not have a material impact on the GroupÕs financial position or results of operations.

The same accounting policies adopted in the annual financial statements for the year ended December 31, 2006 have been applied to the interim financial report.

(2) Turnover

Turnover comprises principally subscription and related fees for Pay television and Internet services, Internet Protocol Point wholesale services and also includes advertising income net of agency deductions, channel service and distribution fees, programme licensing income, film exhibition and distribution income, network maintenance income and other related income.

(3) Segment information

Substantially all the activities of the Group are based in Hong Kong and below is an analysis of the Group's revenue and result by principal activity for the six months ended June 30:

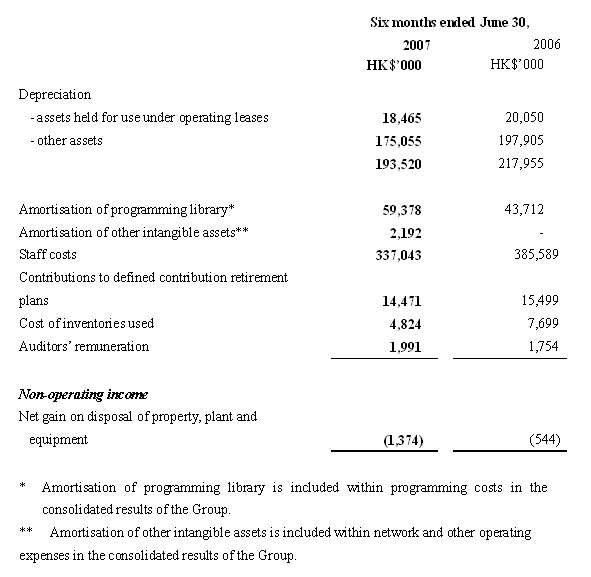

(4) Profit before taxation

Profit before taxation is stated after charging / (crediting):

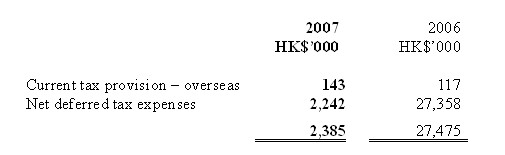

(5) Income tax

The provision for Hong Kong Profits Tax is calculated at 17.5% of the estimated assessable profits for the period (2006: 17.5%). Taxation for the overseas subsidiaries is charged at the appropriate current rate of taxation ruling in the relevant countries. The income tax charge for the six months ended June 30 represents:

(6) Earnings per share

The calculation of basic earnings per share is based on the profit attributable to equity shareholders of the Company of HK$116 million (2006: HK$63 million) and the weighted average number of ordinary shares outstanding during the period of 2,019,234,400 (2006: 2,019,234,400).

The calculation of diluted earnings per share is based on the weighted average number of ordinary shares of 2,019,234,400 (2006: 2,019,234,400) after adjusting for the effects of all dilutive potential ordinary shares.

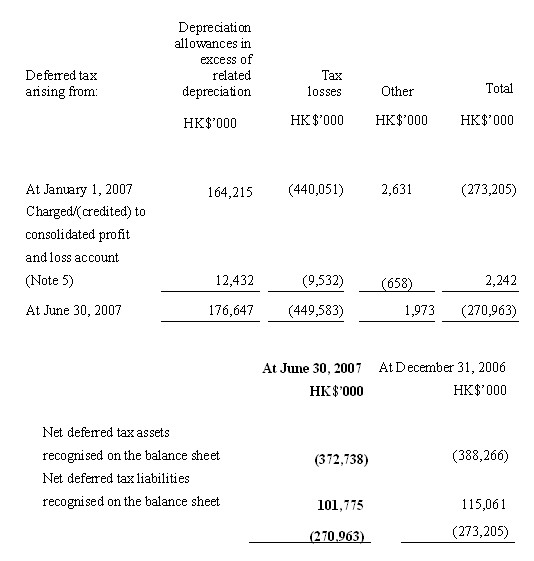

(7) Deferred tax in the balance sheet

The components of deferred tax (assets)/liabilities recognised in the consolidated balance sheet and the movements during the period are as follows:

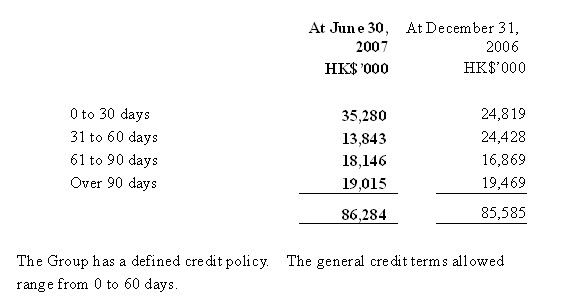

(8) Accounts receivable from trade debtors

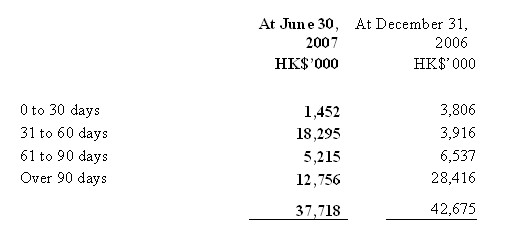

An ageing analysis of accounts receivable from trade debtors (net of impairment losses for bad and doubtful accounts) is set out as follows:

(9) Amounts due to trade creditors

An ageing analysis of amounts due to trade creditors is set out as follows:

(10) Review of results

The unaudited interim financial report for the six months ended June 30, 2007 have been reviewed with no disagreement by the Audit Committee of the Company.

PURCHASE, SALE OR REDEMPTION OF SHARES

Neither the Company nor any of its subsidiaries has purchased, sold or redeemed any listed securities of the Company during the financial period under review.

BOOK CLOSURE

The Register of Members will be closed from Thursday, September 20, 2007 to Friday, September 28, 2007, both days inclusive, during which period no transfer of shares of the Company can be registered. In order to qualify for the abovementioned interim dividend, all transfers, accompanied by the relevant share certificates, must be lodged with the Company's Registrars, Tricor Tengis Limited, at 26th Floor, Tesbury Centre, 28 Queen's Road East, Wanchai, Hong Kong, not later than 4:30 p.m. on Wednesday, September 19, 2007.

By Order of the Board

Wilson W. S. Chan

Secretary

Hong Kong, August 10, 2007

As at the date of this announcement, the Board of Directors of the Company comprises Mr. Stephen T. H. Ng, Mr. William J. H. Kwan and Mr. Peter S. O. Mak, together with four independent non-executive Directors, namely, Dr. Dennis T. L. Sun, Sir Gordon Y. S. Wu, Mr. Patrick Y. W. Wu and Mr. Anthony K. K. Yeung.